13:38: Cambricon Surpasses Kweichow Moutai to Become A-Shares "King of Stocks"

SongGaoTech Harnessing expertise in end-to-end integrated software and hardware customization, we translate your requirements into viable solutions.

August 27th, 2025

At 13:38 on the Afternoon of August 27, Cambricon, a Leading Domestic AI Chip Enterprise, Saw Its Intraday Stock Price Peak at 1,464.98 Yuan, Surpassing Kweichow Moutai to Become the “New King of A-share Stocks”

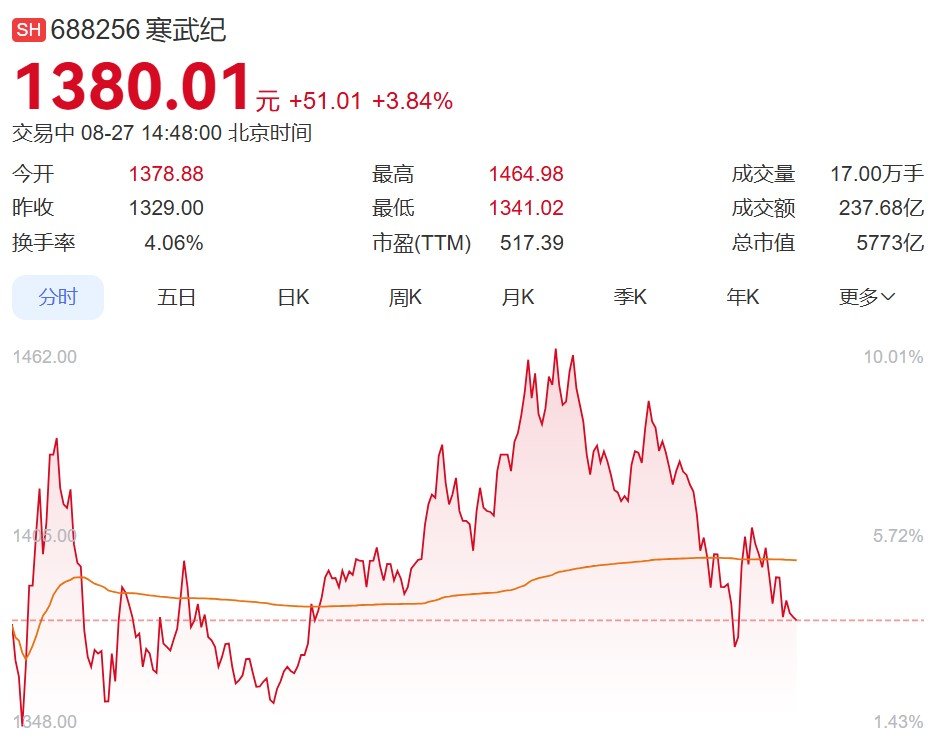

On August 27, Cambricon (688256.SH), a leading domestic AI chip enterprise, saw its intraday stock price hit a high of 1,464.98 yuan, surpassing Kweichow Moutai (with a stock price of 1,460.93 yuan at the same time) to become the “new king of A-share stocks”. Not only did this phenomenon break Kweichow Moutai’s long-standing dominance as the top stock by price in the A-share market, but it also reflects the market’s high recognition of the domestic AI chip track and Cambricon’s leapfrog development driven by performance breakthroughs.

Looking back to January 2023, Cambricon’s stock price once hit a phased low of 54.15 yuan, after which it embarked on a sustained upward trajectory. By the time its stock price surpassed Moutai on August 27, Cambricon had achieved a cumulative stock price increase of over 20 times in less than three years, showing particularly strong growth momentum. Specifically, in this round of market rally, since its launch on July 11, 2025, its stock price has recorded a cumulative increase of over 160% within one and a half months: it broke through the 1,000-yuan mark for the first time on August 20, surged to a high of 1,391 yuan per share on the 25th, and after a short correction on the 26th, it opened with a sharp rise on the 27th, climbing nearly 10% intraday, and finally surpassed Moutai at a price of 1,464.98 yuan.

Behind the impressive stock price performance is Cambricon’s “historic breakthrough” in H1 2025 performance. On the evening of the 26th, Cambricon released its 2025 interim report, which showed that the company achieved an operating revenue of 2.881 billion yuan during the period, surging 4,347.82% year-on-year; its net profit attributable to owners of the parent company was 1.038 billion yuan, which not only turned around its previous loss situation and achieved its first half-year profit since listing, but also set a record-high profit level. At the same time, its net operating cash flow reached 911 million yuan, a fundamental improvement compared to -631 million yuan in the same period last year, with profit quality and operational efficiency improving simultaneously. This better-than-expected “performance report” became the core catalyst for market sentiment, directly driving the stock price to rise sharply on the 27th and surpassing Moutai.