First Half of 2025: Over Half of India's Smartphones Exported to the U.S.

SongGaoTech Harnessing expertise in end-to-end integrated software and hardware customization, we translate your requirements into viable solutions.

August 27th, 2025

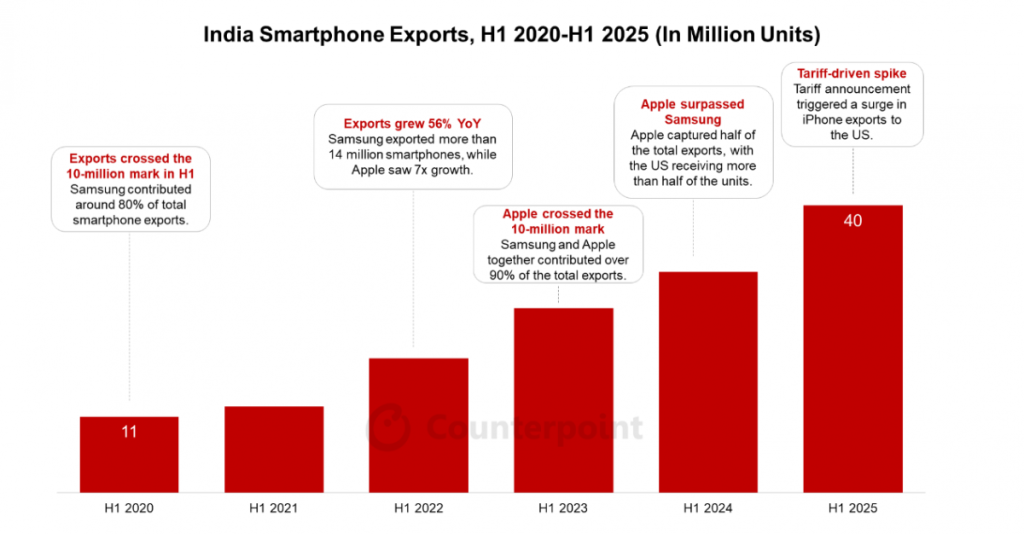

In H1 2025, India’s Smartphone Exports Grew 30% YoY, Driven Largely by Surge in iPhone Shipments to the U.S.

Earlier, the U.S. government announced the imposition of additional tariffs in the first quarter of 2025, prompting Apple to accelerate exports before potential cost increases.

According to Counterpoint Research’s “Make in India Services” report, India’s smartphone exports rose 30% year-on-year to 40 million units in H1 2025. This underscores the continued growth momentum of the country’s electronic manufacturing ecosystem and its growing importance in the global supply chain. Today, nearly 99% of smartphones sold in India are locally produced, a sign that its efforts to build a strong domestic production base have paid off. This progress is attributed to strong government initiatives such as the Production-Linked Incentive (PLI) scheme, as well as the rapid expansion of local production capacity, which has established India as a key hub for global smartphone manufacturing and exports.

In H1 2025, the U.S. remained India’s largest destination for smartphone exports, accounting for 54% of India’s total smartphone shipments—up from 30% in H1 2024—and over 75% of Apple’s exports. A key driver of this growth was the U.S. tariff announcement in Q1 2025, which pushed major brands (especially Apple) to expand exports from India to avoid potential price hikes in the U.S. market and reduce reliance on China.

India’s exports to Europe fell 25% year-on-year, with their share dropping from 47% in H1 2024 to 27% in H1 2025. This was because Apple diverted a large portion of its shipments to the U.S. to boost inventory. Looking ahead, India is poised to become a major exporter to Europe, thanks to the strong export-oriented manufacturing capabilities of Apple and Samsung in India, as well as their leading positions in most markets across the continent.

Apple’s exports in H1 2025 rose 53% year-on-year, surpassing the 20 million-unit mark for the first time. This growth was fueled by the brand’s expanded manufacturing capacity in India, supported by larger production bases and preferential government policies. Additionally, Trump’s tariffs have further boosted the development of export-oriented manufacturing. iPhones dominated the export rankings, taking the top three spots: the iPhone 16 led with 18% of India’s total smartphone export value, followed by the iPhone 15 and iPhone 16e.

In H1 2025, Samsung’s smartphone exports grew slightly by 1% year-on-year. Over 60% of these exports were shipped to Western European markets, such as Austria, Germany, France, and Spain. Notably, exports to the U.S. surged 268% year-on-year in H1 2025. Among Samsung’s exported products, the Galaxy A series accounted for three-quarters of total smartphone exports, highlighting the brand’s continued focus on the mid-range market.

Motorola emerged as the fastest-growing brand in terms of exports, with shipments jumping sevenfold year-on-year to exceed 1 million units—95% of which were sold to the U.S. According to Counterpoint’s Global Monthly Mobile Device Model Sales Tracking Report, Motorola capitalized on the lack of device updates from competing OEMs like HMD and the withdrawal of some smaller brands from the U.S. market, driving a 10% year-on-year increase in its U.S. sales in H1 2025. Motorola launched its 2025 G-series devices earlier than in 2024, tapping into demand during the tax season. Furthermore, in H1 2025, Motorola surpassed Xiaomi and vivo to become India’s third-largest smartphone exporter.

Looking forward, India’s smartphone exports are expected to continue growing, supported by the active expansion of original equipment manufacturers (OEMs) and strong backing from government initiatives (such as the PLI scheme). However, the recent sharp rise in U.S. tariffs on Indian goods—expected to climb to 50%—brings uncertainty to future supply chain dynamics. While smartphones and electronic products currently enjoy exemptions, the temporary nature of these exemptions makes future developments hard to predict. OEMs and manufacturers need to remain agile, adapt to evolving trade policies, diversify their markets, and push for strategic trade agreements to sustain India’s growth momentum in global electronics exports.