Global Top 10 Wafer Foundries Plan to List in Hong Kong; H1 Net Profit Surges 77.61%

SongGaoTech Harnessing expertise in end-to-end integrated software and hardware customization, we translate your requirements into viable solutions.

August 29th, 2025

On the evening of August 28, Jinghe Integrated issued an announcement disclosing new progress in its plan to list in Hong Kong.

Meanwhile, it also released the latest financial report data for the first half of the year.

Earlier this month, Jinghe Integrated announced that “the company is planning to issue overseas listed shares (H-shares) and list on the Hong Kong Exchanges and Clearing Limited (HKEX)”. Yesterday (August 28), the company issued another announcement to reveal new progress in its Hong Kong listing.

In addition, Jinghe Integrated also released its 2025 interim report yesterday. The company achieved a net profit attributable to owners of the parent company of RMB 332 million, representing a year-on-year increase of 77.61%.

Jinghe Integrated, a Wafer Foundry, Plans to List in Hong Kong

According to Jinghe Integrated’s announcement earlier this month, the Hong Kong listing is intended to deepen the company’s international strategic layout, accelerate the development of overseas business, further enhance the company’s comprehensive competitiveness and international brand image, while fully leveraging the resource and mechanism advantages of the international capital market to optimize the capital structure and expand diversified financing channels.

On the evening of yesterday, the company stated in the “Announcement on Engaging an Audit Firm for H-share Issuance and Listing” that it intends to appoint Rongcheng (Hong Kong) Certified Public Accountants Limited (hereinafter referred to as “Rongcheng Hong Kong”) as the audit firm for this issuance and listing.

At the same time, at the 25th meeting of the second board of directors held on August 28, 2025, Jinghe Integrated also adopted the “Proposal on Amending and Related Rules of Procedure (Draft) for the Company’s H-share Issuance and Listing” and the “Proposal on Amending and Formulating the Company’s Internal Governance System for the Company’s H-share Issuance and Listing”.

Anhui’s First 12-inch Wafer Foundry

Founded in May 2015, Jinghe Integrated is a joint venture established by Hefei Construction Investment Holding (Group) Co., Ltd. and Powerchip Innovation Investment Holding Corporation. Located in the Comprehensive Bonded Zone of Hefei Xinzhan High-tech Industrial Development Zone, it is the first 12-inch wafer foundry in Anhui Province.

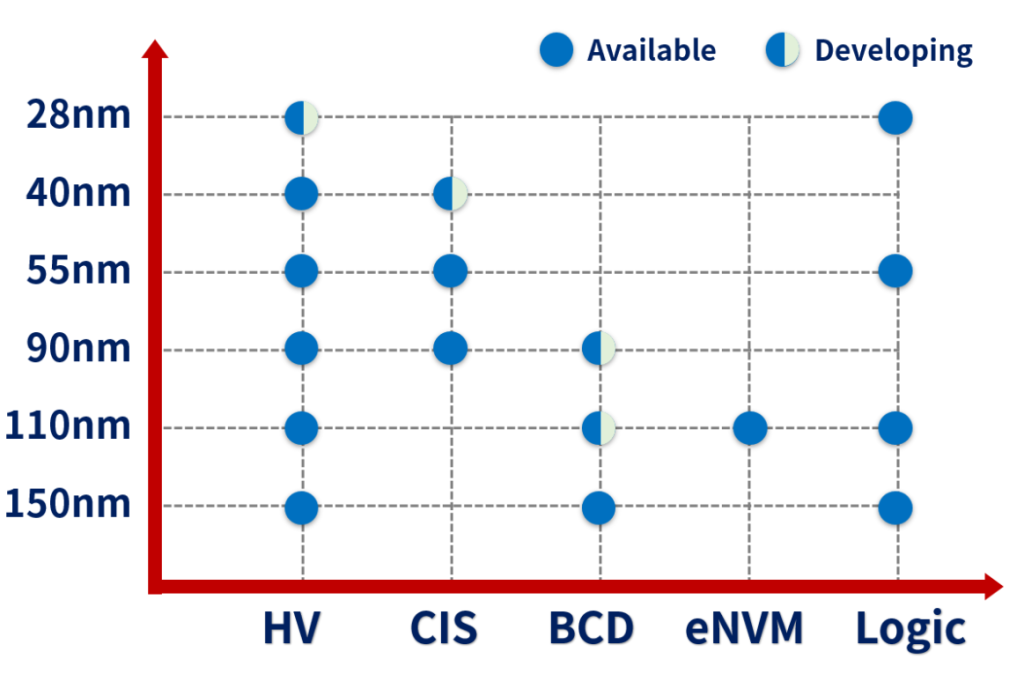

Jinghe Integrated focuses on semiconductor wafer manufacturing foundry services, and is committed to contributing to the improvement of China’s independent and controllable integrated circuit manufacturing capabilities. It provides customers with different process technologies ranging from 150nm to 40nm, and will introduce more advanced process technologies in the future. In May 2023, Jinghe Integrated was officially listed on the STAR Market of the Shanghai Stock Exchange, becoming the first pure wafer foundry enterprise in Anhui Province to successfully list on the capital market.

Currently, Jinghe Integrated has a monthly production capacity of over 100,000 12-inch wafers, with its products covering platforms such as DDIC, CIS, MCU, PMIC, and logic applications. In 2024, the company achieved several milestones: mass production of the 55nm mid-to-high-end BSI and stacked CIS chip process platforms; mass production of 55nm automotive display driver chips; mass production of 40nm high-voltage OLED display driver chips; and successful functional verification of 28nm logic chips, which have successfully lit up TV panels.

Net Profit Surges 77.61% Year-on-Year in H1 2025

In the first half of 2025, Jinghe Integrated achieved an operating revenue of RMB 5.198 billion, representing a year-on-year increase of 18.21%; a net profit of RMB 232 million, up 19.07% year-on-year; a net profit attributable to owners of the parent company of RMB 332 million, surging 77.61% year-on-year; and a net operating cash flow of RMB 1.705 billion, an increase of 31.65% year-on-year. The company’s comprehensive gross profit margin in H1 2025 stood at 25.76%.

Jinghe Integrated stated that the growth in operating revenue in the first half of the year was mainly due to the increase in the company’s sales volume during the reporting period, leading to continuous growth in revenue scale. The year-on-year growth in net profit attributable to shareholders of the listed company was primarily driven by the year-on-year increase in operating revenue, as well as the high capacity utilization rate maintained by the company, which resulted in a decrease in unit cost of goods sold and an improvement in the gross profit margin of products. The year-on-year increase in net cash flow from operating activities was mainly due to the year-on-year growth in operating revenue during the reporting period, which led to an increase in cash received from the sale of goods and provision of services.

Jinghe Integrated further pointed out that the company has improved its gross profit margin by continuously enriching product categories and optimizing product structure. By process nodes, in the first half of 2025, 55nm, 90nm, 110nm, and 150nm accounted for 10.38%, 43.14%, 26.74%, and 19.67% of main business revenue respectively, while 40nm began to contribute to revenue. By application products, DDIC, CIS, PMIC, MCU, and Logic accounted for 60.61%, 20.51%, 12.07%, 2.14%, and 4.09% of main business revenue respectively, with the revenue share of CIS and PMIC products continuously increasing.